Liability insurance coverage is a kind of https://www.canceltimeshares.com/blog/what-happens-if-i-just-stop-paying-my-timeshare/ safety net. It covers the expense of claims made versus you, such as medical expenses for injuries another individual sustains. It can likewise cover other losses those people have. For example, if a tree branch from your tree falls onto your next-door neighbor's shed, your policy can cover the damage to that structure.

Liability insurance typically begins at $100,000 on a basic house insurance policy, however you may wish to buy a greater level of coverage. Many insurance providers use as much as $500,000 of coverage https://www.timesharestopper.com/blog/best-timeshare-cancellation-company/ on a house insurance coverage policy. To buy a greater quantity of liability coverage you might need to buy an additional policy called an "umbrella" policy which increases the liability coverage on both your home and car policies.

From the insurance coverage you require for your house's structure to the coverage you require for liability dangers, there is much to consider here. Home owners gain from having comprehensive defense and the property owners insurance premium ought to cover every one of these components for you. At Plymouth Rock Assurance, our team of insurance professionals will work carefully with you to understand what your home insurance needs are.

You can then adjust the protection as you please. With correct homeowners insurance coverage, you can rest easy knowing you have financial defense in location Find more information to lessen threats to you from losses you can not otherwise control. Let Plymouth Rock help you find an economical policy that fulfills your needs. The details on this page is for informative purposes just and is not expert or professional recommendations.

Things about What Is A Premium In Health Insurance

We make no representations or guarantees concerning the efficiency, accuracy or suitability of the details on this page. Nothing on this page changes the terms or conditions of any of our policies. Real protection is limited to the protections and limitations acquired by each policyholder and undergoes the language of the policy as provided by us.

Ask a home builder to walk through your house and quote of what it would cost to restore. That figure needs to be the basis for how much replacement protection you need - how does health insurance deductible work. If you have anything of extraordinary value, such as a family treasure or a work of art, you must acquire extra coverage for those items.

House owners insurance secures your house, its contents, and, indirectly, your other possessions in the occasion of fires, theft, accidents or other disasters. A standard property owners policy (known as an HO-3 policy) will safeguard you from things like fires and fallen trees. Notification how we didn't point out floods or earthquakesthose events are particularly not covered by a basic policy and need extra coverage.

A standard policy will likewise safeguard your ownerships from said disasters in addition to theft. But a basic policy is not a blank check: there's a limit to just how much you'll be compensated. If you have specific items of worth, such as precious jewelry or art work, you can pay a little extra each year to insure them for their complete replacement worth.

Some Known Details About What Is A Premium In Insurance

Property owners insurance coverage covers your liabilities in this scenario also. And like the examples mentioned above, you can pay more for additional protection. Property owners insurance coverage isn't needed by law, like car insurance. But mortgage business typically require you to acquire a policy before they'll offer you a loan. Your home-insurance policy needs to cover enough to completely reconstruct and provide your home were it cleaned off the map.

Make certain to mention any special and/or pricey information that would contribute to the replacement cost. Once you have actually identified the replacement expense of your home, you'll need to know what kind of coverage you want. There are a couple of key terms here: This implies that the insurer will spend for the restoring of your home no matter the cost.

Lots of insurers use protection that caps the payout at around 125% of your home's insured value. This feature makes certain that your house's insured worth stays present with the marketplace. If you get a trusted appraisal, extended replacement coverage and an inflation guarantee, you need to be in good condition. The appraisal supplies a sensible beginning figure and the inflation assurance ensures that your home's price remains present.

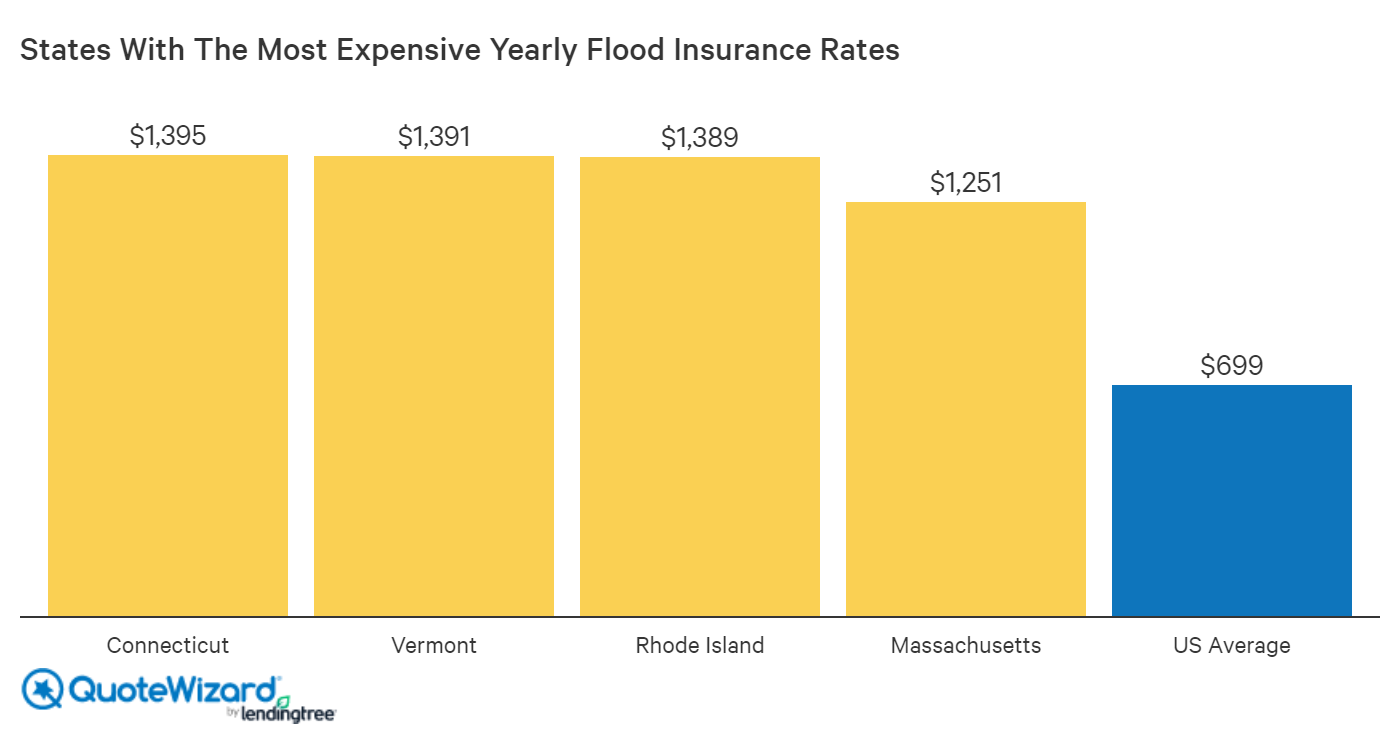

One last thing: The law requires you to have flood insurance if you live in a formally acknowledged high-risk area. To find out your flood threat and to find strategies (which are offered by the government), go to floodsmart. gov. When it concerns safeguarding your ownerships, you may desire more coverage than your basic policy allows. what is a premium in insurance.

Little Known Facts About What Is Short Term Health Insurance.

Insurance companies will charge additional for this protection (something like an additional $10 on your month-to-month premium per $1,000 of value insured), however it pays to be covered. Likewise bear in mind that there are two different kinds of protection when it concerns individual posts. There's "real money value" and there's "replacement expense." You desire protection for replacement expense.

Replacement Cost Insurance pays you the amount of cash you 'd require to buy a brand-new product to change your old one. Say a guest remains at your home and slips on the flooring and sprains his ankle. He chooses to sue you. Your homeowners policy includes liability coverage in case you lose the lawsuit.

Supplemental liability coverage can boost your security to $1 million or more. If you do not own a car, including that sort of coverage can be reasonably cheapless than $100 per yearand isn't a bad concept. If you do own a vehicle (putting you at greater danger for causing damage to individuals and residential or commercial property), anticipate to pay $300 to $400 a year.

There are 3 sort of home insurance provider and salespeople: who offer straight to customers (GEICO, Progressive and USAA fall under this classification); who only sell one company's insurance coverage items (for instance, State Farm and Allstate representatives); and, who sell policies from various business. It's possible that all of these groups will reject your insurance application for anything from the dangerous pool of alligators in your backyard or the twister that runs through your residential or commercial property every year.

How Much Does Long Term Care Insurance Cost - An Overview

Many states have state-sponsored insurance programs for the hard-to-insure. Browse for your state's FAIR (Fair Access to Insurance Requirements) prepare if you're having a hard time with the standard insurers. Like car or medical insurance, your house owners insurance coverage has a deductible (the amount you must pay before protection begins).

If you do, the expense of your insurance premium (the month-to-month costs you pay) will undoubtedly be lower. Plus, a low deductible forces your insurer to cover more of your expenses costs they hand down to you in the form of increased premiums. Keep in mind: You should not use insurance to cover every possible expense, just the huge ones.

Insurance companies dislike it when you file a lot of claims, and may raise your regular monthly premium or perhaps cancel protection since they'll see you as too dangerous. It's not about guttersyou desire the insurance coverage when you have to spend for an entire brand-new roof. An excellent guideline of thumb to follow: If you can repair anything for less than $1,000, don't sue.